Last edited

03/11/14

FTAlpha - FastTrack Alpha

FTAlpha is a selection method that combines return, risk, and correlation into a single

indicator value.

- FTAlpha encompasses

the concepts of Modern Portfolio Theory, MPT.

- FTAlpha diversifies your portfolio to

provide risk reduction while shifting the portfolio to top performers.

- FTAlpha generally works best when selecting from a universe of 40-50 mutual funds and exchange traded funds (ETFs), but will also work within

a portfolio holding dozens of large cap stocks from a universe of hundreds of stocks.

- FTAlpha is usually used in Momentum

Models. However, even when using Momentum, FTAlpha effectively acts as a Value model during

periods when your portfolio loses money. Click for

details.

Click for an example of

FTAlpha Momentum trading.

Interpreting FTAlpha on the Spreadsheet Tab

Assuming that your portfolio is adequately represented by the

low risk basis line (see

Mimicking below), then ranking of any family of funds or stocks

by the

FTAlpha

column will separate those issues into three groups:

- Positive FTAlpha. These issues added to your portfolio should reduce

risk and increase return.

- Near zero value FTAlpha: Changing positions in these issues will not improve the risk/return of

your portfolio except to the extent that you sell and use assets to purchase higher ranked

issues.

- Negative FTAlpha: These issues when removed from your portfolio should reduce risk and

improve returns.

FT4Web does not give you a canned way to build an exact portfolio line, but

"exact" is not necessary and may even be undesirable.

- If a single issue accounts for 40% or more of assets, just

put that fund in the green ColorBar cell.

- If you hold 10 or more mutual funds, then

likely your current portfolio resembles the S&P 500. Put

VFINX in the green ColorBar cell.

- If you hold, for example, 5 funds with

each being in excess of 10%, then put all funds in the Chart Tab's issue

list. Set the Appearance dialog

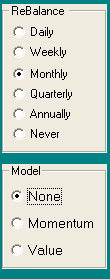

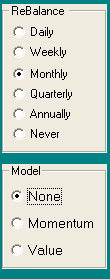

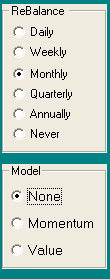

settings to Rebalance=Monthly Strategy=None. Set the green ColorBar cell

to AVG.

- If most of your assets are in a few stocks, and you

trade regularly each week,

then FTAlpha will not be of any help.

- Set the the low risk basis 'green Line'.

There is no magic in creating this green line. The line needs to only

approximate your holdings.

Starting the Momentum Modeling

- For any period, the lowest ranked FTAlpha issues are sold until 25% of assets are in cash.

- The assets are used to buy equal dollar amounts of the top 10% of issues based on the

FTAlpha score. For example for a family of 40 issues, assets would be

divided evenly among the top

4 issues.

Note: if you mimicked your portfolio as suggested above but

actually the portfolio is,

- 60% in Fund X,

- and if the model suggests adding more Fund X,

- then, do not add more Fund X.

- Allocate assets to other high ranked funds.

Using the Spreadsheet to

Make Trades

If you are trading monthly, then after updating

on the 31st, you would follow the instructions below, and place trades for

execution on the close of the next trading day.

- Load family that represent your holdings.

See Mimicking Portfolio above. Compute a Monthly Rebalanced None Model AVG in the green line .

- Set the Low Risk Basis

to the green line.

- View the Charts. Set the Dashed Pole a

month back.

- Go to the spreadsheet and add an FTAlpha column

and a COR column.

- On the Chart Tab load a diversified family

from which you will choose your trades. It should always include funds that

you are currently holding

- Hit the K key to rank the family

- Sort the Spreadsheet by the FTAlpha column (click the top of the column)

- Now you are ready to place trades with your broker. Remove or

reduce the low ranked funds in your portfolio. Add the high ranked funds.

FT4Web's Model trades 25% of assets each period, but you can vary that. If you trade too much of your portfolio, then you will lose the

diversification which is essential. FTAlpha tells you what to add to complement your existing

holdings, but if you trade 75% of assets each period, then there will be nothing left for the new

holdings to complement.

You don't HAVE to use the same diversified

family every period. We DO

recommend that you change the family regularly to add new interesting diverse funds.

Weekly and Annual FTAlpha rankings rarely produce desired results. Monthly

and Quarterly rankings work better.

Interpretation #1: Building a Portfolio

- Adding issues to your portfolio with high positive FTAlpha Values will improve performance and

decrease volatility of your portfolio.

- Adding issues with positive FTAlpha and high correlation will improve

portfolio performance, but with increased volatility.

- Adding Issues with Low FTAlpha will hurt portfolio return

without reducing risk.

- Adding Issues with Low FTAlpha and low Correlation will hurt return, but

may substantially reduce risk. Bear funds often fall into this category.

Interpretation #2: Managing a Portfolio

- Increase your position in issues with high FTAlpha and low correlation.

This will reduce volatility and increase return.

- Increase your position in specific issues which have positive FTAlpha. This will increase return and reduce risk.

- Increase your positions in issues with neutral FTAlpha (hovering

around zero) and low Cor=. Reduce positions in issues with neutral FTAlpha and high Cor=. This will reduce volatility without hurting

return.

- Reduce holdings in issues with negative FTAlpha.

- Consolidate holdings with neutral FTAlpha and high

Cor=

- Review issues with negative FTAlpha and low Cor=. These may

be providing a comforting hedge (volatility reduction). Consider moving

some assets to money market to achieve the same result.

- During periods when the momentum strategy is

failing (the Low Risk Basis or the Momentum AVG line has a negative return

for the period), then FTAlpha will effectively become a value model:

Take profits on the winners and invest in the

losers. This can be disconcerting.

Restated: When Momentum strategy is failing, then the Value Strategy is

likely winning. Taking profits on your winners and investing the proceeds in

issues that have already fallen is a reasonable, time-honored strategy.

LIMITATIONS:

Ideally, members of your family would be issues that

have about the same Standard Deviation( SD= ). If your family contains funds that range from a SD of 1 to 18, then FTAlpha trading will focus on the extreme members and ignore the members in

the middle range of volatility. Your results will be poor.

If your family only has 3-5 members, then FTAlpha will pretty much hold

all of them in roughly equal portions most of the time. As one member

becomes over weighted, it becomes highly correlated with the portfolio and

FTApha down rates it to a sell. Ideally, you should trade from a diverse

family of 10-100 members.

As with most technical analysis, funds are

easier to analyze than stocks. Funds, including sector funds, will be more

likely to continue their past volatility and correlation with respect other

funds . . . stocks are much less likely to continue their trends.

However, FTAlpha trading does work, but you have to hold 10-20 stocks to

achieve risk-adjusted returns approaching a Momentum Model holding 3-6

funds.

|

| |