Distributions,

Dividends Distributions,

Dividends

When They Send You the Profits!

Updated

06/26/17

Where are Distributions found within FastTrack?

All types of distributions (general term for dividends, splits, capital

gains, etc.) change the total return of an issue.

Distributions are put on the T and P Chart as white dots on the red line. The

white dot for splits is bigger. When you

move the Dashed Pole to a white dot, the distributions

descriptions

popup . You can right-click on that label to temporarily disable the distribution popup if

you don't care about dividend details.

FastTrack's Spreadsheet will also list

distribution totals. Tax Spreadsheet. will compute

the gains/losses you should report on your tax returns.

What Is a Distribution?

Distribution is a general term applied to several different types of

transactions.

C - LT CapGains

Long-term Capital Gains: The most common form of capital gains is distribution of

cash from a mutual fund who sold appreciated assets held more than a year by the mutual fund. You

may also have capital gains paid to common stock share holders.

L - Super LT CapGains

These distributions were created by the tax reduction of 2001 for assets

purchased after 1/1/2001 and held more than 5 years. There is a quirk in the

act which allow conversion of assets bought before 1/1/2001 to use the new

reduced tax rate by paying the old rate on pre 1/1/2001 gains and then the

new rate on subsequent gains. Therefore, mutual funds that converted may have Super

LT CapGains well before 1/1/2006.

D - Income

Dividends are the most common form of distribution. Dividends are the payment of money to

share or bond holders. Usually dividends are taxable as ordinary income except dividends

from a municipal bond fund, but consult your tax adviser for details As of

1/1/2003, this includes "Qualified Dividend" which are taxed at lower rates

under the 2003 tax reform bill. We continue evaluating the inclusion of

these dividends as a specific category.

G - ST CapGain

Short-term capital gains: These are capital gains from assets held less than a year. In 1998,

Congress, in its collective wisdom, instituted other holding periods which greatly

confuses the capital gains treatment. FastTrack

contains only short and long dividend characterizations.

I - Split Dollar Amount

Most of these distributions are for mutual fund splits. They are carried as a dollar value

rather than a split ratio. This category is probably unnecessary, but is used within

FastTrack for DOS which does not offer the split ratio handling.

Z - Split Ratio

These distributions are shown as a ratio based on the closing price of the underlying

stocks. Splits are common with stocks, but also found in a few mutual fund histories.

S - Stock Div

Used for certain types of complicated transactions. FastTrack carries the value of share

splits as a dollar amount value. For example the AT&T spin-off of Lucent, we

calculated the closing price of Lucent shares on the first day they could have been sold

by an AT&T shareholder and reinvested those proceeds in AT&T shares at the closing

price on the same day.

Most of these transactions are special cases which have to be hand-worked, Our figures for

total return MAY not agree with other published figures. We are interested in any

feedback on these issues. When you call us, please be prepared to cite the source, amounts, and

dates of the figures you have obtained that are different from FastTrack's. Also, if your

nonFastTrack numbers are the result of a computation, please provide the formula the other

source is using. We will investigate our own data and formula's even if you cannot provide all

the listed information, but may be unable to explain differences.

R - Return of Cap

The return of capital from liquidations of mutual funds of common stocks. This is a rare

type of distribution.

U - Current Gain

This type of distribution is usually associated with an international mutual fund.

T - Rights

This is the offering by a mutual fund or stock company to sell current shareholders discounted

securities issued by the company. These rights often have a real value that expires over

time. DO NOT ignore a right offering as you will likely lose investment value. Consult

your financial adviser for more details.

O - Other

Distributions that do not fit characterizations above.

Ending

Shares - Assuming that you start with one share, these are the number of

shares reinvested. FastTrack always starts with one share on the first day.

Projected Dividends - These are dividends that have been

announced for future dividends but are not issued yet. They are subject to

change. When dividends are distributed ,they could be different amounts and

on different dates.

|

FT4Web Charts are Adjusted for Reinvestment and Splits

Almost all distributions affect the total return of your investment. FT4Web always reinvests

distributions in more shares of the same issue effectively changing the number of shares that you

own.

On the FT4Web chart, return computations are always based on a single share at the close of the

first day displayed. When a distributions occurs, then FT4Web reinvests the dividend at the close on

the X-Date. This mirrors the most common practice for funds and for stocks with DRIP (Dividend

Reinvestment Plan). The FT4Web return will hold true even if the "Pay Date" for the distribution is

later than the X-Date. When the reinvestment occurs , on a date later than the X-Date or at a price

other than the X-Date closing price, then FT4Web's total return will differ.

In summary, the FastTrack database contains all distribution information per share. Your brokerage statements and

the dividends reported at each white dot will agree on the distribution amounts.

But I think your adjustment method is wrong. How'd you do it?

Print the Distribution Adjustment Work Sheet.

This document shows how FT4Web does the calculation.

Comparison to Value Line

The section below is reproduced from the 3/6/98 issue of Value Line reports. Note the

"Div'd Decl's" enlarged section. Compare that to IBM on your FastTrack screen.

|

|

Unlike FastTrack, Value Line reports historical distributions as split-adjusted values.

The Value Line totals for a period will agree with FastTrack's totals for the same period

WHEN the period ends AFTER the last distribution or the period includes a split. The

totals will NOT agree when the period ends before a split. Value Line's distribution

information WILL NOT agree with your brokerage statements, whereas FastTrack's information

will agree.

The individual distribution values reported by Value Line will agree with

FastTrack's individual distribution values if there has been no split AFTER the

distribution. When there has been a 2-for-1 split, for example, then FastTrack

distribution values BEFORE the split will be double the Value Line reported values. In this

case, FastTrack's values will agree with your brokerage statements, Value Line's

will not agree. FT4Web's computations are fully disclosed in the

FTDIS.CSV

file.

Distributions can Affect Price strongly, but have Slight Impact on Total

Return

Most distributions are cash removed from the portfolio and paid to you.

After the distribution, each share is no longer worth as much. The price of

shares decreases by the distribution amount. The decrease occurs on the

"X-Dividend Date" designated by the issuer of the share at the market close

for the x-day. Usually this is the within a very few days that the issue

pays the distribution to you.

A few mutual funds may hold distributions in their own account for more

than a couple of days before paying you on a "Pay

Date". This causes a problem. The fund price reflects the removal of

the distribution from the x-date closing price, but there is no reinvestment

in new shares or cash payments in your brokerage account. Yet, FastTrack

will show the redistribution of those dividends. In fact, FastTrack's Total

Return will be a best guess at the actual value of your holding, but it

won't agree with the low figure what your brokerage reports to you.

Eventually, you will collect the dividend paid on the x-date even if you

sell the shares before the Pay-Date, and at that point FastTrack and your

brokerage will show total return that is almost the same. Although the

distribution X-amount is removed from your brokerage account, it is still

invested in much the same way as your portfolio and as such the net impact

on your total return on the Pay Date is usually very small.

Generally, the delay in Pay-Date serves to smooth the process of

rebalancing a portfolio. Assets are traded in an orderly manner with buys

and sells netting out evenly with a pad of the unpaid distribution

masking some volatility.

Distribution Totals & Yield Calculation

The Distribution summary is displayed when the Dashed Pole is moved to

the last day of the chart. The numbers are accurate for the period of the chart's width. When

there have been several distributions during the period, the computations for deriving totals

and yields are quite complex. The computations are fully disclosed in the

FTDIS.CSV

file.

Note: Distributions on the very first day of the chart are NOT

included in the return and yield computations for the rest of the period. Distributions are

applied at the close of market and included in the period when the

distribution x-date is the last date of the period measured.

Note: FT4Web's are fully disclosed in the

FTDIS.CSV

file.

Chart Total - Distribution Summaries

When the Dashed Pole rests on the last date of the chart, then FastTrack computes a

summary of distributions. This display can be disabled by right clicking on the

chart and unchecking the Div Info Show menu item.

One Year Yield= The yield of the most recent one year period. This

calculation treats income dividends as distributed (they send you a check) instead of reinvested.

This is the same as the spreadsheet Yield1Y amount. Click

here for or more discussion.

Income reinvested= Total cash distributions for the period displayed. The

calculation treats income distributions as reinvested, hence, there are more shares over

time and the distribution compounds. This means that Income reinvested= is, always,

somewhat higher than the raw sum of the distributions over the period. This amount is

equivalent to the amount on which you would pay taxes as it is the sum of income

distributions when such distributions are reinvested.

Note: FastTrack allows reinvestment in fractional shares. This is always possible with

mutual funds, but seldom possible for stocks. Therefore for stocks, the FT reported

Income Reinvested= may be slightly higher than reality.

Short + Long CapGains Reinvest= - Total of short + Long term

capital gains for

the period displayed. The total considers that each distribution is

reinvested in additional shares. The amount shown should be deducted

from assets before paying taxes when the shares are finally sold. You will have already paid

taxes on this amount.

Unrealized CapGains: The amount of capital gains that

would occur for one share bought at the beginning of the chart if sold on

the last day of the chart.

- Show Tax SpreadSheet: Clicking this

menu item produces a detailed, itemized list of distributions suitable for

calculating tax liability. The output is a file named,

C:\FT\FT4WIN\TEMP\TAX.CSV

FT4Web will attempt to open this file invoking whatever program

(usually a spreadsheet program like Microsoft Excel.) you have selected to

handle CSV files. From your spreadsheet program, you will be able to view

and customize the tax spread sheet calculation for your purposes.

Wall Street's Dirty Little Distribution Secret

We hate to be the bearer of

bad news. Wall Street has little secrets that can really mess up your return. We hate to be the bearer of

bad news. Wall Street has little secrets that can really mess up your return.

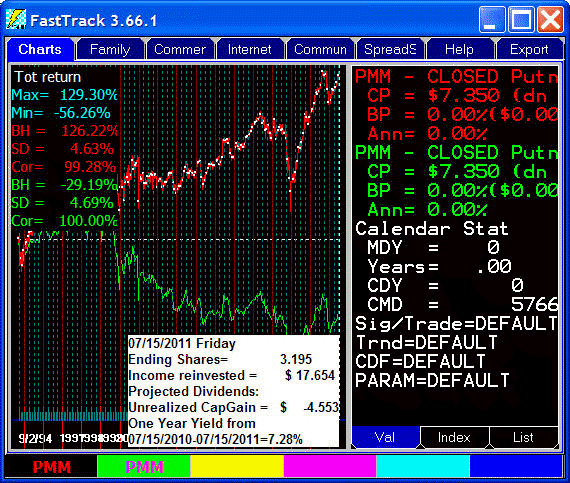

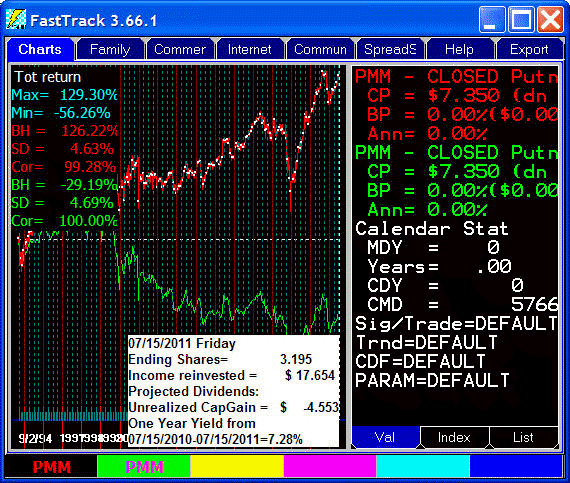

This Closed End Putnam fund shows that it has a 7.28% yield (income

dividends). This happens to be a Municipal bond fund, but there are many similar

funds which are taxable.

- Unfortunately, a lot of that yield has come from simply handing

back your initial capital investment as dividends. Note that the

green line (your capital

value) continually drops. They are giving back your initial investment as a

dividend artificially inflating the yield.

- If PMM were held in a taxable account (of course, modify these comments

for this municipal bond fund), you end up paying taxes again on money

that has already been taxed once. Note that the

green line is the same

red PMM fund, but with the

FT4Web "ignore Dividends" option selected.

- FT4Web reinvests distributions the closing price on the X-Date. But if

you have asked your broker to reinvested dividends automatically, then you

may not get the save price as used by FT4Web(and other sources).

- Watch out! If everyone automatically reinvests at the market

"open" price on the same day, the open price may spike up making the

automatic reinvestment at a very unfavorable price.

In general, you should NOT reinvest dividends paid by stocks and open end

funds automatically. Have the dividends go to cash and use that cash as part of

your regular rebalancing plan. Also . . . examine the reasons you own a fund

like this carefully. NEVER hold it in a taxable account. This DOES NOT apply to

company sponsored DRIP plans for which the company issues new shares, or

provides shares from a source (its own holdings) that are not acquired through

market trading on the X-Date. See details of your DRIP program.

Final comment: Note that FT shows a capital loss of $4.553 per share. This

capital loss may NOT be fully deductible, costing you a sizable (relative to the

dividends) loss of income. We are not tax experts . . . check with your own

financial consultant as to how this affects you.

|

Distributions,

Dividends

Distributions,

Dividends

We hate to be the bearer of

bad news. Wall Street has little secrets that can really mess up your return.

We hate to be the bearer of

bad news. Wall Street has little secrets that can really mess up your return.