A Practical Example

FastTrack used to provide B- . . . families. These were families of funds

that could be purchased through brokerages. These families were discontinued

because they were no longer needed since virtually all brokerages now can

purchase at least one class of any mutual fund.

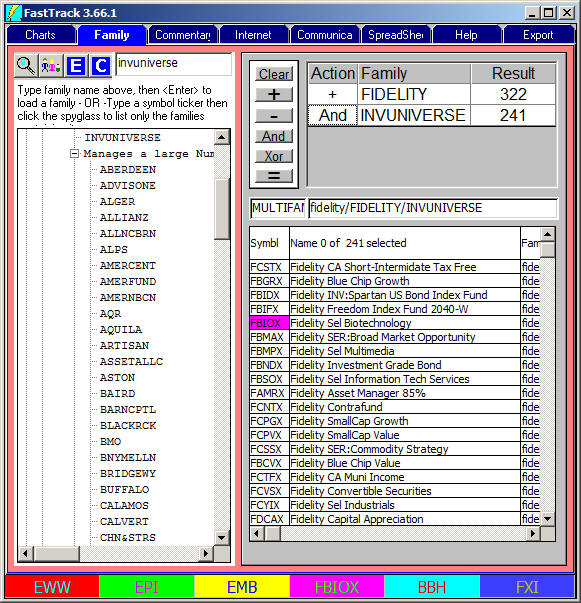

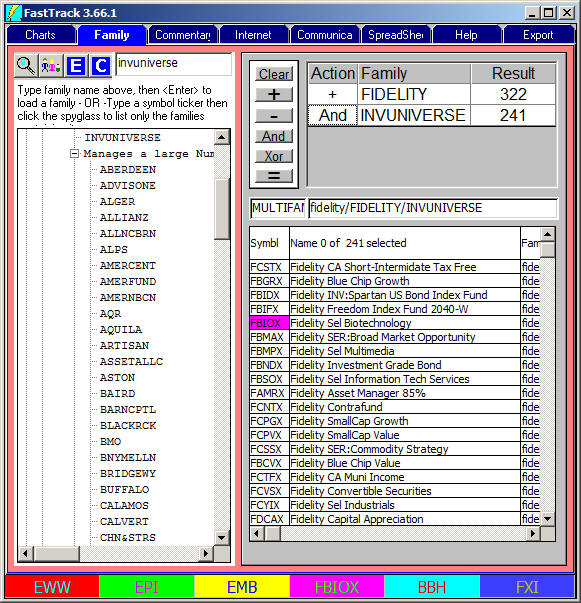

Here's how to create a new equivalent family of low cost funds. Use the Sieve to combine the

InvUniverse Family with any other family.

The results in the list are members of both Fidelity and InvUniverse families.

In this example, the nearly 322 Fidelity funds are reduced to 241 funds that

can be purchased through most brokerages at low cost with no load.

The broadest application would be to simply load the

InvUniverse family.

However, there would be many, many diverse funds which would be difficult to

narrow down into a rational diversified family. By using Fidelity, Rydex, or

Vanguard family with InvUniverse, the resulting list of funds will be less

redundant. i.e. You won't have to choose among twenty S&P 500 Index funds.

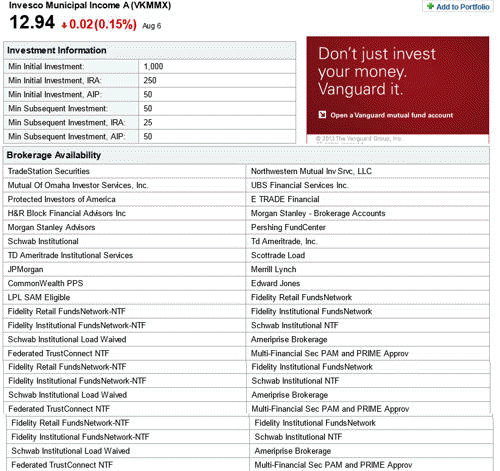

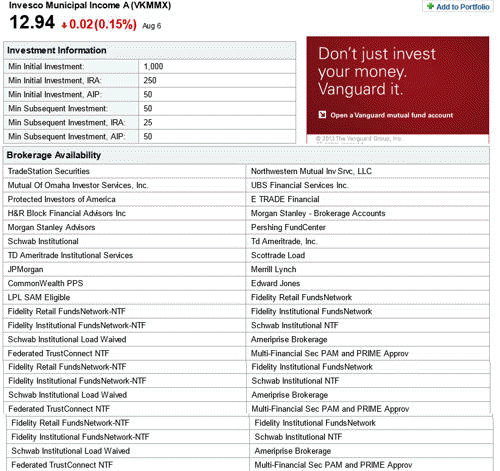

One more example as of 8/6/2013

We combined the ALL-BOND AND

INVUNIVERSE families. One of the members, VKMMX, has been a Class -A load

fund in the not too distant past.

However, Notice that this partial Morningstar-Source listing shows that VKMMX

is available in a variety of Fidelity NTF programs. Unfortunately, such

memberships change so quickly, that Fidelity (and other brokerages) do not

make a comprehensive NTF list easily available to individual investors.

Having picked a particular fund, you may have to search the brokerage's NTF

web site to get the exact class ( -R, -I, -Y, ad infinitum) which find which

fund currently available as NTF.

|

Action Buttons

Action Buttons