To Start

Right-click on any of the Chart Labels. There are three chart labels

showing on this chart. The lowest is "Rel Strength"

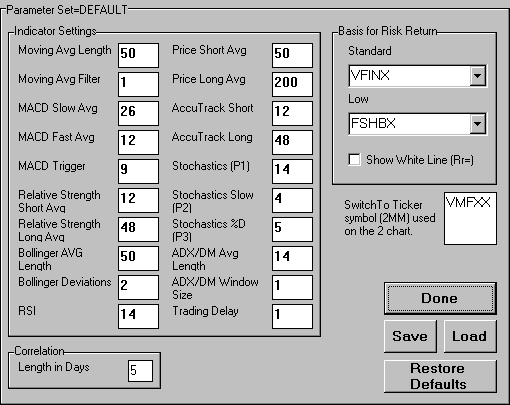

What do the Parameter Numbers Mean?

In this chart the Parameter numbers are

12

48 under the white words,

"Rel Strength"

SHow the parameter Numbers by left-clicking the chart label.

Most Parameters are specified in market days. A parameter of 50 means averaging over 50

market days. This is equivalent to averaging for 10 calendar weeks. In general, increasing

parameter values decreases the switches/year. Decreasing parameter values increases the

switching/year. The optimum parameter value yields the greatest total return with

an acceptable number of switches/year. For more discussion of each indicator click the

links above.

For a discussion of calculation formulae, please see Mathematical

Computations.

|

Switch to Ticker (2MM)

This is the ticker symbol of an issue that the 2 Chart will pick up when doing timing. Click for more detail. Generally, put a money market fund

ticker symbol into

this box, but it may be any issue's symbol. This issue is used in the calculation of the Mr= values on the Charts Tab.

It is also used as the green segments of the 2 Charts

composite line

Correlation

This special parameter governs the way the Cor= performance values and the Cor=

spreadsheet column are computed. Click for more details.

Restore Defaults

This will restore the values saved in the c:\ft\ft4win\parameters\default.prm

file. These are values established by FastTrack as having general value. In other words, not

magic parameters, or even smart parameters. You may save your own settings in the default file

if you wish.

Note there is a second default.prm file,

c:\ft\ft4win\parmaeters\userdef\default.prm. Whenever you shut down FastTrack. The

current parameters are saved in this file. These parameters are restored when restarting FT. So

you have the same parameters when your restart as when you shut down.

Basis For Risk Return

These settings determine,

- the way that the white line of the

J and 2 Charts are drawn.

Set both the Standard and Low Risk Basis.

- the basis for calculating the Ulcer Performance Index (UPI).

Set the Low Risk Basis only.

- the basis for calculating NCAlpha.

Set the Low

Risk Basis only.

- the basis for the calculation of FTAlpha.

Set the Low Risk Basis only.

- the basis of the Sharpe Ratio computation.

Set the Low Risk Basis only.

For a very full discussion of the use of these Standard Risk Basis and the

Low Risk Basis settings, click

here.

Show White Line

The J and 2 Chart can display a white line that shows the expected return

of the red line. Click for details.

Save/Load

Click these buttons to save the current settings or to load them back. When

FastTrack commentary defines and transmits a parameter set it goes into the

C:\FT\FT4WIN\PARAMETERS\ folder. When you define a parameter set you should

store it in C:\FT\FT4WIN\PARAMETERS\USERDEF\ folder as FT may, at some

point in the future, transmit parameters of the same name into the..\

PARAMETERS\ folder and destroy your saved set.

|

There are two selection boxes. Click

on the down arrows to see the choices. Pick two funds, stocks, indexes, or averages to define

the Standard Risk Basis and Low Risk Basis.

Suggestions

VFINX occupies the broad middle of equity averages. Thus, it is a good

choice as one of the parameters.

-

When rating HITECH funds, then VFINX might be the Low Risk Basis with NDX-X

as the Standard Risk Basis.

-

For INCOMEQ funds (low volatility, dividend paying stock fund), VFINX might be the Standard

Risk Basis and FSHBX (Short-term bond fund) the Low Risk Basis.

-

For Value Funds funds, instead of VFINX, use VIVAX, a Vanguard Value Index

fund the standard basis.

But what about Strange funds

For example,

JAPAN funds have always followed their own course with little regard for US

Markets. Using VFINX as a basis would be a very bad choice.

Instead, rank the JAPAN funds for the period

desired and make the fund with the Highest SD= the "Standard Risk Basis". Make the fund with the

lowest SD= for the period the "Low Risk Basis".

Special Note

Do not enter a symbol like

"LIST AVG" or "SELECT AVG" in this area. It does work,

but will recompute the average

many, many times as you use FT slowing down your work. Instead, save

the AVG as an FNU file. This file will be used instead of recomputing

the AVG. Do not enter a symbol like

"LIST AVG" or "SELECT AVG" in this area. It does work,

but will recompute the average

many, many times as you use FT slowing down your work. Instead, save

the AVG as an FNU file. This file will be used instead of recomputing

the AVG.

|

Do not enter a symbol like

"LIST AVG" or "SELECT AVG" in this area. It does work,

but will

Do not enter a symbol like

"LIST AVG" or "SELECT AVG" in this area. It does work,

but will